3a: for outsiders, this might look like a house number or a bus route, but for anyone in Switzerland between the tender age of 18, or whenever they start work, and the retirement age of 65, it’s something very important. The third pillar enables you to set aside a certain amount of savings for a private pension that you control yourself: in short, having this financial support can make you more independent. A pillar 3a account is a smart option if you plan to maintain the lifestyle to which you’ve become accustomed even after you retire – and to be honest, who wouldn’t want to? The secret to success is building up your own savings, and for anyone doing so, pillar 3a is a particularly smart way of putting money aside. With Yuh 3a, your money won’t simply be left to wallow in a savings account. Instead, it’s profitably invested over the long term according to one of five clever strategies.

You say 3a, I say 3b: but what’s the difference?

Pillar 3a

At the moment, it’s likely that the more appealing option is a pillar 3a account. That’s because, depending upon the amount paid in, you’ll benefit from significant tax advantages until it’s eventually paid out, since this type of pension scheme is supported by the Federal Government. Each year, a statutory maximum is set for the amount you’re allowed to pay in. You can only access the money saved in a 3a account before you retire under highly specific circumstances, and if you decide to do this for any reason, you’ll also have to pay tax on the amount withdrawn. Obviously, the first thing that springs to mind when thinking about a «tied» pillar 3a is that it can fill gaps that we would otherwise have in our old-age pension. But pillar 3a can do three more things: it can, for instance, provide a mechanism for saving up for a long-term home that you live in yourself, and it can also offer assistance in the event of adverse outcomes caused by either disability or death.

Pillar 3b

The benefits offered by pillar 3b, which is also referred to as «unrestricted» pension provision, differ from those provided by its sister, pillar 3a. You can pay in as much as you like each year, regardless of whether you are working or not. Since pillar 3b is separate from your pension, you are free to choose both the term and the time of payment. At Yuh, you can use pillar 3b to invest in ETFs and the like via savings plans, say. The only downside is that you can’t deduct from tax any amounts paid in, and the total savings are taxed as an asset. However, no taxes are charged when the balance is paid out.

When should you get going with your third pillar?

Better sooner than later. But one thing at a time: if you want to maintain your existing standard of living after you retire, you’ll need to receive around 80% of your last gross salary. If the amount of your pension is lower than 80%, you’ll fall victim to the so-called «pension gap».

The early bird gets the worm

A pension? For young adults, that seems like a distant concern. But, as the saying goes, «the future is now» – and this is absolutely the case when talking about money. In turn, it makes sense if you broaden your financial room for manoeuvre and benefit from investments and cumulative returns over the long term.

You can start paying into a pillar 3a account as soon as you start working. In other words, you have to be earning an income liable to old-age and survivor’s insurance (OASI) contributions. By law, employers are obliged to pay OASI contributions for each worker from 1 January after the worker in question has reached the age of 17 (i.e. the year in which they turn 18).

You can start paying into a pillar 3a account as soon as you start working. In other words, you have to be earning an income liable to old-age and survivor’s insurance (OASI) contributions. By law, employers are obliged to pay OASI contributions for each worker from 1 January after the worker in question has reached the age of 17 (i.e. the year in which they turn 18).

Why pillar 3a is worth it

Tax benefit

Each year’s pillar 3a contributions are tax-deductible, which means that your taxable income is lowered by the same amount. When completing your tax return, all you need to do is enter the amount paid, enclose the payment receipts, and Bob’s your uncle, you’ve trimmed down your tax bill.

For example: an unmarried person resident in Zurich with a taxable income of 100’000 CHF can save up to 1’700 CHF by paying in the maximum amount.

You decide how much to pay in

The benefit for you as a scheme member is that you can decide for yourself how much you want to pay in, up to the maximum amount allowed by law. You can also hit the pause button whenever you like, as you’re not obliged to pay in every year.

Early withdrawal

In some cases, you can access your pillar 3a cash early. You can do this, for example, if you’re buying a home (to be occupied long-term by you), switching to self-employment or leaving Switzerland for good. Pay-outs might also have to be made as part of the marital property settlement in the event of divorce. You can also withdraw your pillar 3a balance five years before you reach OASI retirement age.

Investing pays

People across Switzerland are happy to park their savings in a pillar 3a account (68 percent of them, as of 2020), but they don’t know how much is actually slipping through the net by not doing so. Saving money is all well and good; however, your savings are losing value due to the combined effect of inflation and low interest rates at the moment. The benefit of investing is that your money can grow over the long term (for instance, by investing in an equity fund with a long investment horizon) and rise in value in line with the market. With Yuh 3a, you can invest your pillar 3a cash and reap higher returns as the years go by.

For example: a woman who invests 7’000 CHF entirely in equities each year will have around 531’000 CHF when she reaches OASI retirement age, assuming an annual return of 4%. This stands in stark contrast to the sum of 258’000 CHF from a savings account with an annual interest rate of 0.30%.

Have a look yourself. With our Yuh 3a calculator, you can simulate various scenarios (from mild to fiery) with either larger or smaller equity components and find the right solution for you.

The clear benefit for you of having a broadly diversified portfolio is, without doubt, price gains. Past observations make it plain that, over the last 200 years, no assets have offered returns as high as the global equity markets. Since 1969, the Swiss equity market alone has generated an average annual return of 5.57%.

And on the subject of returns: have you ever heard of compound interest? Albert Einstein even referred to this as the «eighth wonder of the world». It enables your investments in equities to grow in a wondrous way, especially over a long-term investment horizon – and thanks to the dividends paid out by blue-chip stocks, which you’re sure to get with Yuh 3a.

The clear benefit for you of having a broadly diversified portfolio is, without doubt, price gains. Past observations make it plain that, over the last 200 years, no assets have offered returns as high as the global equity markets. Since 1969, the Swiss equity market alone has generated an average annual return of 5.57%.

And on the subject of returns: have you ever heard of compound interest? Albert Einstein even referred to this as the «eighth wonder of the world». It enables your investments in equities to grow in a wondrous way, especially over a long-term investment horizon – and thanks to the dividends paid out by blue-chip stocks, which you’re sure to get with Yuh 3a.

Specifically, these dividends are a key factor in the long-term success of an investment, as the pay-outs are automatically reinvested in securities. At the end of the next period, these newly created assets, in turn, earn a return of their own. You’ll benefit from this disproportionally as a pensioner: this is what compound interest is all about. Since 1969, assuming dividends are reinvested, the average annual return from the Swiss equity market has increased from 5.57% to 8.07%.

Bright prospects or what?

Show us where you save…

… and we’ll tell you who you are. Joking aside, banks and insurances offer their own pillar three solutions. The aim is always to give your cash that extra push so it can finally start working for you. Just ask yourself where you feel more at ease.

A bank

A banking solution means that you take the annual savings amount and either pay it into a traditional bank account and leave it there, or invest it in an equity fund and let the money work for you.

Insurances

If you prefer an insurance company, you’ll get a bundled product offering insurance and allowing you to save towards a pension: under this solution, you’re forced to pay the annual savings amount stipulated under the contract – kind of like a premium. The amounts saved are invested in securities and start working for you.

What’s better?

Or to put it in other words: is flexibility important to you, or do you prefer operating within a solid framework?

If you’re the flexible type, you’ll probably like the bank solution more, as you are free to decide whether and how much you’d like to pay in.

Under an insurance solution, this freedom slips away from your grasp, as you’re practically forced to pay the contractual premium each year. At the moment, Swiss savers have a clear preference for banking solutions, with only around a third currently (in 2020) opting for an insurance solution.

Pro tip: it’s worth understanding the difference between banking and insurance solutions. If you decide to invest in equity funds, you should ask the right questions before taking the plunge.

Pro tip: it’s worth understanding the difference between banking and insurance solutions. If you decide to invest in equity funds, you should ask the right questions before taking the plunge.

Who can pay into a pillar 3a account?

If you have income liable for OASI contributions, you’re eligible for pillar 3a savings. The maximum permitted amounts differ, depending upon whether you’re employed or self-employed.

Maximum amounts

The maximum amounts that can be paid into the account are published by the Federal Government each year. As an employee, you’ll normally be a member of your company’s pension scheme, and so will be able to pay in the maximum annual amount – 7’258 CHF. If you’re not a member of a pension scheme, or are self-employed, say, you can pay in up to 20% of your annual income from work, subject to a cap of 36’288 CHF.

How long can I pay into pillar 3a for?

You can keep paying in until you reach your retirement age. For instance, a woman can pay in the maximum amount before her 64th birthday, and then withdraw the same amount immediately afterwards. Although the rules on deductible payments differ from canton to canton, you can normally deduct these payments from your taxes. Some cantons allow the entire amount, others limit the deduction to net income, and others, in turn, take work-related expenses into account. If you want to voluntarily work for longer, beyond your retirement age, you can keep paying into your pillar 3a account.

Retrospective payments

From 2026, you can retroactively fill missed Pillar 3a contributions from the past 10 years, starting with gaps from 2025, if you had AVS-subject income. Gaps must be filled in one payment per year and only apply to future gaps, not those from years without income. The maximum retroactive contribution for 2025 is 7’258 CHF.

Pay-outs

Date

Pillar 3a savings are blocked until five years before OASI retirement age, but can be withdrawn at any time after that until retirement. However, if you’d like to carry on working beyond normal retirement age, you can defer withdrawal for up to a maximum of five years. Even though it would be nice to be able to do so, you can’t draw down your pillar 3a account or pillar 3a custody account in stages after you retire. Unfortunately, you can only get hold of your cash in one go. What about tax? This obviously involves a drawback, but there’s a solution for this too: use more than one 3a fund to avoid tax disadvantages!

Withdrawing pillar 3a savings early

You could consider an early withdrawal under the following circumstances:

- purchase of owner-occupied residential property

- repayment of a mortgage (taken out to finance a home that you live in yourself long-term, as long as you are the owner or co-owner of the property)

- permanent relocation to a foreign country

- disability

- self-employment

Pillar 3a and divorce

Issues can arise in relation to pillar 3a savings in the event of divorce. If you and your husband or wife have not agreed upon the separation of property in the event of divorce, any pillar 3a savings accumulated by either of you during the marriage will be split between you. It’s irrelevant whether the money has been deposited in a pillar 3a bank account, invested in a pillar 3a fund or used to pay for an insurance policy.

More means less

As a general rule, you’re allowed to have as many pillar 3a accounts as you like.

However, experts normally recommend no more than 2 or 3 accounts. That means that you can close down the accounts gradually, while at the same time significantly reducing your overall tax burden over multiple tax periods.

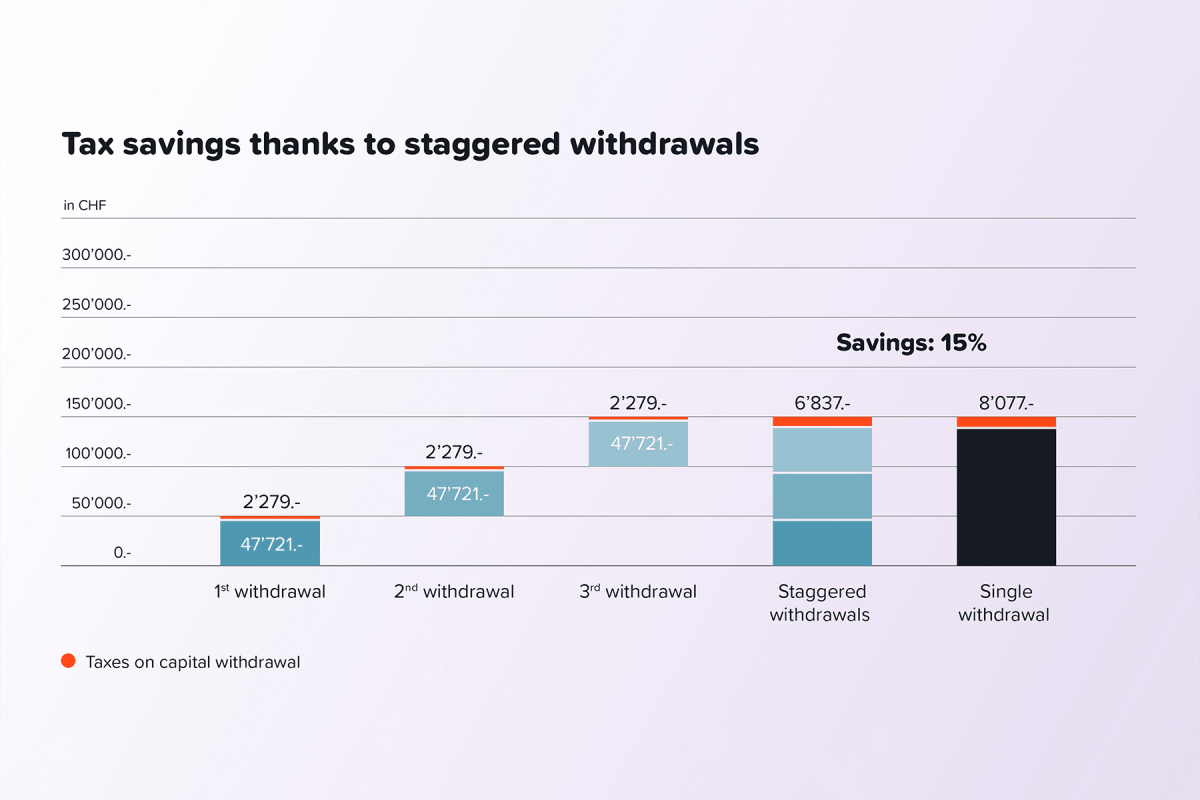

The important thing to know is that money invested in a pillar 3a account is only subject to income tax or withdrawal tax once. And when you think about it, this makes sense: the higher the payout, the more tax you pay. For example, if you withdraw 50’000 CHF in 2021, and then another 50’000 CHF during each of the following two years, that’s generally more advantageous than taking out the full 150’000 CHF in 2021 (unless you’re an unmarried man without any children living in the Canton of Zurich). If married couples or registered partners withdraw their pillar 3a retirement savings during the same tax year, the amounts are cumulated and then taxed together. Exceptions apply, depending upon the canton.

The key points at a glance

Not interested in reading all the fine print? Here’s a quick rundown for anyone in a hurry.

- Private old-age pension schemes are known as «pillar 3a» or «third pillar» in Switzerland.

- As soon as you start working (as an employee or a self-employed worker), you can pay a maximum amount specified by law into a pillar 3 account each year until you retire.

- You can deduct your contributions from tax, and under certain circumstances you can also withdraw amounts before you retire.

- There is also a pillar 3b. Here there’s no maximum limit, but also no tax benefits.

- Investing your 3a savings in securities makes sense over the long term, as you’ll receive higher returns and benefit from compound interest. At Yuh, we’ve worked out five investment strategies to suit every taste.

- You can either save into a 3a account through a bank or via an insurance policy – don’t forget to read the small print if you opt for insurance!

- If you invest in more than one pillar 3a account, you’ll receive an additional tax benefit at the time of withdrawal.